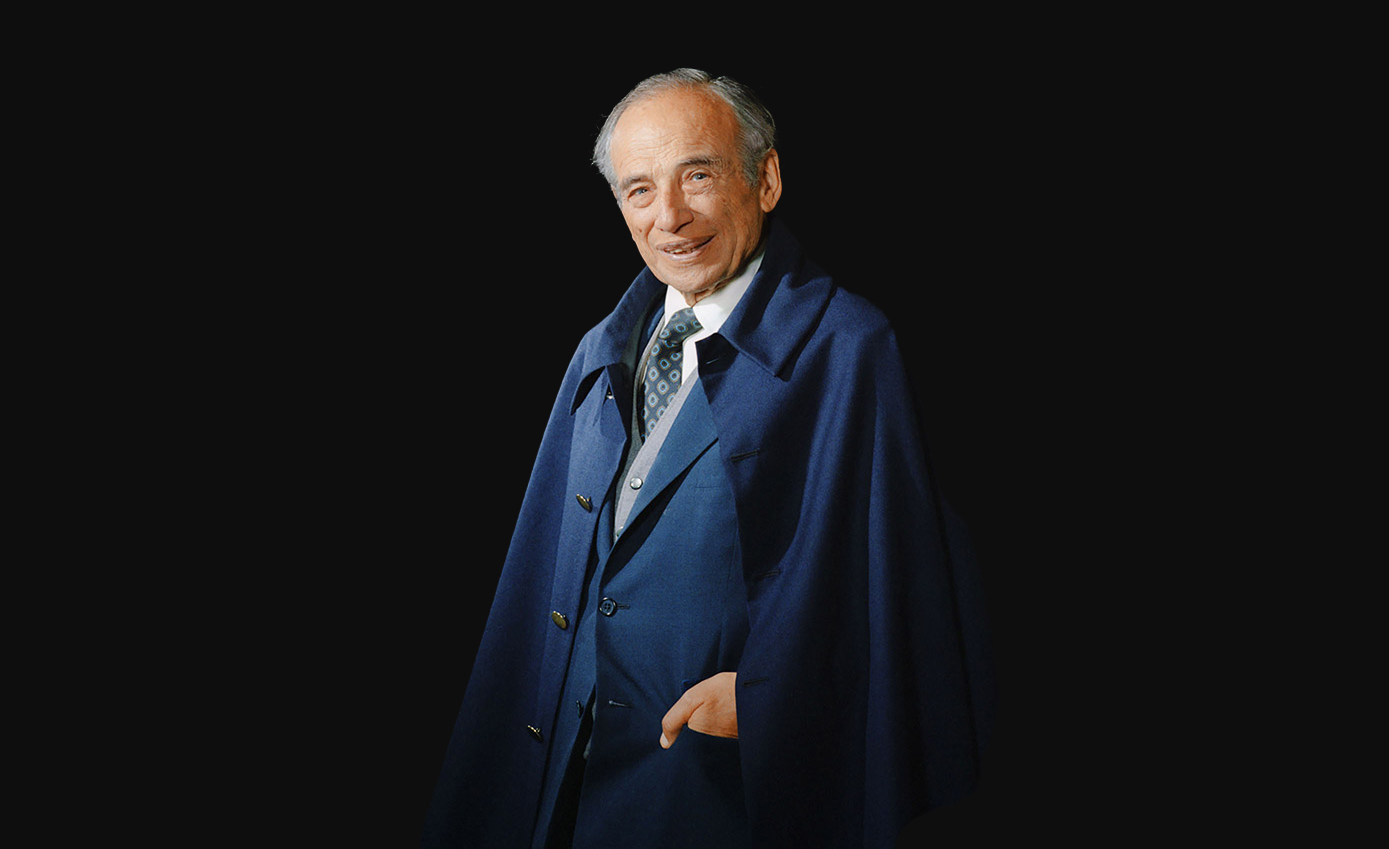

Benjamin Graham (1894–1976) was a renowned American economist, investor, and professor at Columbia Business School. He is often referred to as the “Father of Securities Analysis” and the “Guru of Value Investing.” Graham developed a systematic method for selecting securities based on fundamental analysis principles. Some of his most significant contributions to investing are published in his book “Security Analysis” (1934), co-authored with David Dodd. This book is considered one of the most important works in the field of financial analysis and value investing.

Graham focused on identifying undervalued stocks, incorporating a margin of safety concept to protect investors from significant losses. Graham’s most well-known book is “The Intelligent Investor” (1949), considered a classic in financial literature. In this book, he introduces the idea that a true investor should behave more like a business owner and emphasizes the importance of discipline, research, and patience in investment decisions. In addition to his books, Graham had a significant impact on the financial world through his work as an investor and as a teacher of investors, including Warren Buffett. Buffett considers Graham one of his most important mentors and has emphasized that Graham’s ideas had a lasting influence on his own investment philosophy.

From Prosperity to Poverty – The Struggle of a Talented Child

From Prosperity to Poverty – The Struggle of a Talented Child

Benjamin Graham was born in 1894 as part of the Grossbaum family in London, which immigrated to the United States a year later as his father aimed to establish an American branch of the Grossbaum porcelain trade. In the initial years, Benjamin lived amid the prosperity of New York with his two older brothers. However, in 1903, his father passed away, marking the beginning of the family’s economic decline. Ben’s mother lacked business acumen, initially failing in attempts to start a boardinghouse. In 1907, during the financial crisis, she nearly lost the entire family fortune through leveraged stock speculation.

This formative experience may have contributed to the later emphasis by the legend of value investing, Benjamin Graham, on the importance of capital preservation. Unlike his future student Warren Buffett, the young Graham initially showed less interest in business matters and instead opted for a classical education. Graham was a comprehensively gifted student, a bookworm who skipped several grades. The rightful hope for a scholarship to Columbia College was initially thwarted by a mix-up within the university administration.

When this confusion was corrected the following year, the then 17-year-old found that he had lost a year. He set a goal to complete his studies in only three instead of four years. Ultimately, Graham graduated as the second-best in just two and a half years, which is all the more remarkable as he worked full-time during this period. After graduating, Graham received offers from various institutions to pursue an academic career, including in philosophy, mathematics, and English literature. However, the college dean recommended a Wall Street career to the 20-year-old. In 1914, Graham accepted a position at the brokerage firm Newburger, Henderson & Loeb, despite never having taken an economics course.

Benjamin Graham: The Beginning of a Success Story

Benjamin Graham: The Beginning of a Success Story

After initial tasks as a messenger, Benjamin Graham quickly rose in the bond department of his employer. While he realized he wasn’t a talented bond salesman, he recognized his skill as a “statistician,” as securities analysts were called at that time. As there was no official analysis department at Newburger, Henderson & Loeb at the time, Benjamin Graham was promptly assigned as this “department.” In 1915, he achieved a significant success in the field of value investing. Graham discovered that the Guggenheim Exploration Company, in the process of dissolution, was vastly undervalued compared to the individually traded company shares. This presented an arbitrage opportunity. The success encouraged Graham to acquire more undervalued stocks. In 1920, he was made a partner in his firm, and his income was estimated at half a million dollars when he was just 26 years old.

The Formation of Graham Newman Corporation

Three years later, Benjamin Graham took the step to establish his first asset management company, and in 1926, he embarked on a new venture with Jerome Newman. Two years later, he was appointed to Columbia University, where he taught until 1957. Among his students were numerous future stock market legends such as Warren Buffett, Walter Schloss, and Irving Kahn. The stock market crash of 1929 initially brought the rapid pace of his life to a halt. Of the $2.5 million managed before the crisis, only $375,000 remained in 1932. Over the next five years, Graham worked without pay to restore his clients’ wealth. At the same time, he co-authored the work “Security Analysis” with David Dodd, which was first published in 1934 and is now considered a classic in financial literature.

In 1949, Graham published the book “The Intelligent Investor,” aimed at a broader audience, inspiring Warren Buffett to study under Graham. The student became the master, and Buffett was the only student to receive an A+ grade in a Graham course. In 1954, Warren Buffett was admitted as an employee to the Graham-Newman partnership. Just two years later, Benjamin Graham decided to retire. Until then, he had never again lost money and had achieved a return of 17 percent per year for his clients.

From that point on, Benjamin Graham enjoyed his personally turbulent life – he was married three times – and passed away in 1976 in France. His own epitaph read: “This man remembered what others forgot, and forgot much that everyone remembered. He learned long, worked hard, and smiled often, fortified by beauty and captivated by love.”