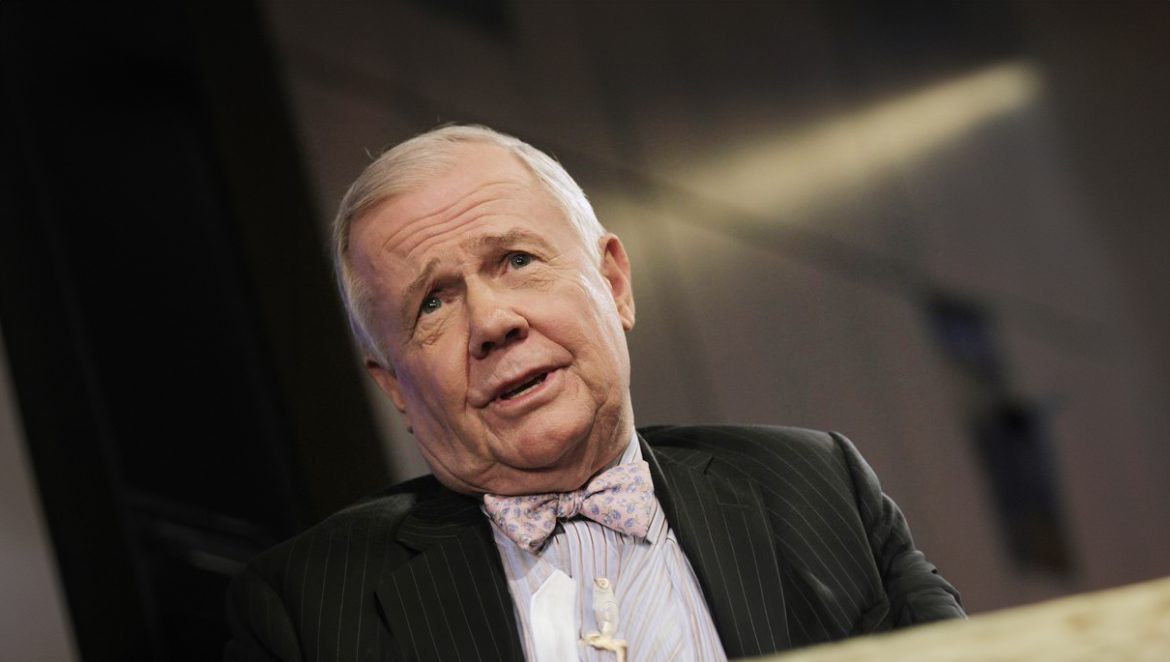

Jim Rogers: The Indiana Jones of Finance

Jim Rogers: The Indiana Jones of Finance

After leaving Quantum Funds in 1980, the former hedge fund manager took on a guest professorship at Columbia University. This university once had Benjamin Graham, the father of the value approach, as a teacher, and among Graham’s students were stock market giants like Warren Buffett. In 1990, Rogers began realizing his lifelong dream: The young retiree, together with his then-girlfriend Tabitha Estabrook, traversed six continents on a motorcycle, covering over 65,000 kilometers in two years in search of investment opportunities. Due to this impressive journey, immortalized in the Guinness Book of World Records, the magazine “Time” dubbed him the “Indiana Jones of Finance.”

After this epic journey, the adventurer focused exclusively on managing his own wealth for a considerable period. In the mid-90s, he developed the “Rogers International Commodity Index,” or RICI, to reflect general living costs.

In January 1999, the globetrotter embarked on another world tour with his current wife, Paige Parker. In 1,101 days and covering 245,000 kilometers in a specially modified Mercedes SLK, he expanded his knowledge of different countries, cultures, and industries. As a kind of record of his experiences, the book “Adventure Capitalist,” published in 2003, can be considered.

Jim Rogers: A Glimpse into the Future

Rogers is so convinced of China’s future strength that in December 2007, he moved to Singapore with his wife and two daughters. He justified this by stating that China was too dirty and unhealthy even for a young family. At that time, the speculator strategically divested all US dollar positions and primarily switched to what he considered safer currencies like the Canadian dollar and the Australian dollar. Additionally, he invested in agricultural commodities as well as gold and silver. “The future belongs to Asia. Moving to Asia now is like immigrating to the USA at the beginning of the 20th century,” explained Rogers.

As another argument for a complete exit from the US dollar, the market expert points to the fact that both Alan Greenspan and his successor Ben Bernanke have turned on the printing press at the first sign of recession to escape it. Therefore, the next economic downturn will hit the USA even harder, according to Rogers.