The Early Years of Peter Lynch

The Early Years of Peter Lynch

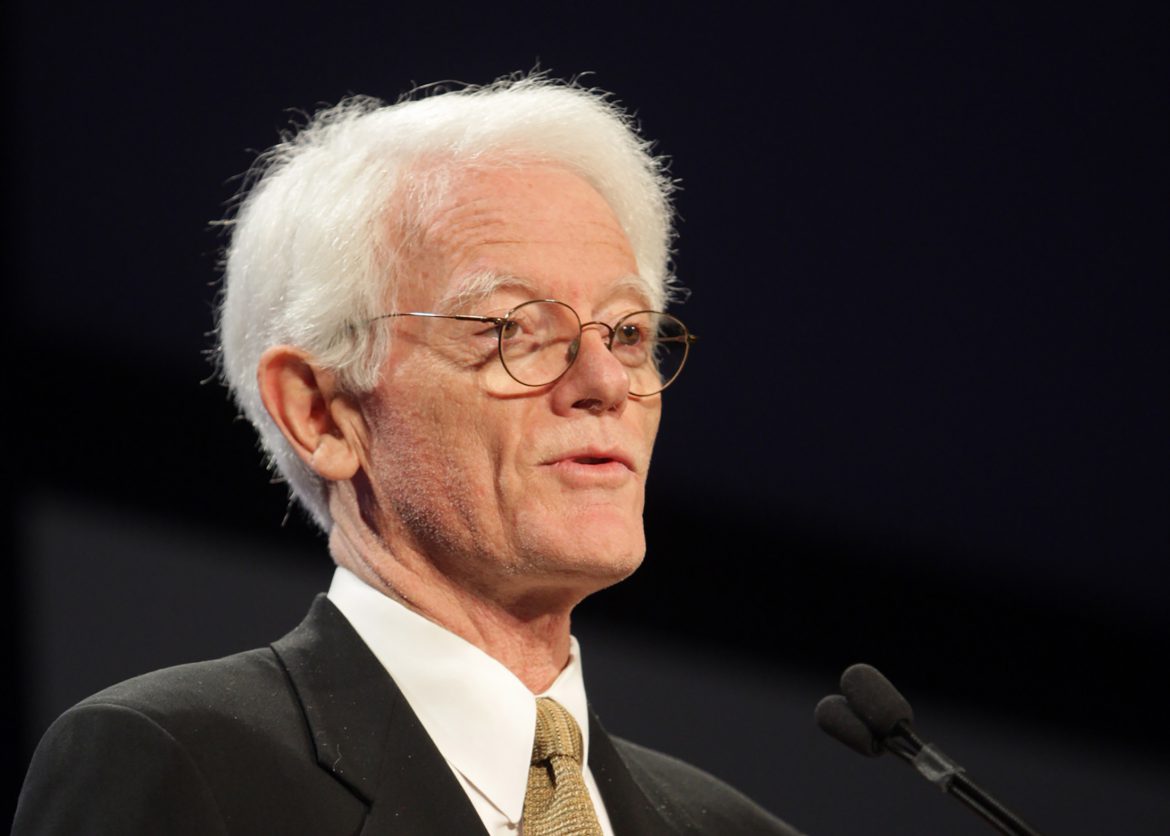

Peter Lynch was born on January 19, 1944, in the American city of Boston. At the young age of eleven, he gained his first experiences in the financial and business world by working as a caddy on a golf course. The observant boy listened attentively to the conversations of investors playing there, took notes, and noticed months later that the values had risen. These early experiences formed the foundation for one of the investment strategies Lynch later developed.

The Career of Peter Lynch

After graduating from Boston College in 1965, Peter Lynch continued his studies with a three-year Master of Business Administration at the Wharton School of the University of Philadelphia. During his studies, he interned with his future employer, Fidelity Investments. After his two-year military service, Lynch was eventually hired full-time by Fidelity.

In 1977, Peter Lynch experienced a breakthrough in his career when he was entrusted with the management of the then relatively unknown Magellan Fund. Under his leadership, the fund grew from an initial $20 million to an impressive $14 billion in the 13 years Lynch was at the helm. The Magellan Fund surpassed the one billion U.S. dollar mark within just six years. At the peak of his career, the seasoned investor decided to retire from the stock market business at the age of 44. Lynch, often referred to as “The Chameleon,” earned this nickname due to his pragmatic and adaptable approach to various investment strategies and ideas, which he changed depending on the market situation.

The investment principles formulated by Lynch are characterized by rationality and openness. Unlike many investors, he never relied exclusively on a specific strategy or idea but adapted his tactics flexibly to the respective situation. This versatility and flexibility earned him the nickname “The Chameleon.”

It is interesting to note that the most successful stock speculators in the world pursued different strategies but shared a common goal: acquiring stocks at opportunistic times and then holding them for as long as possible during their meteoric rise.

Pages: 1 2