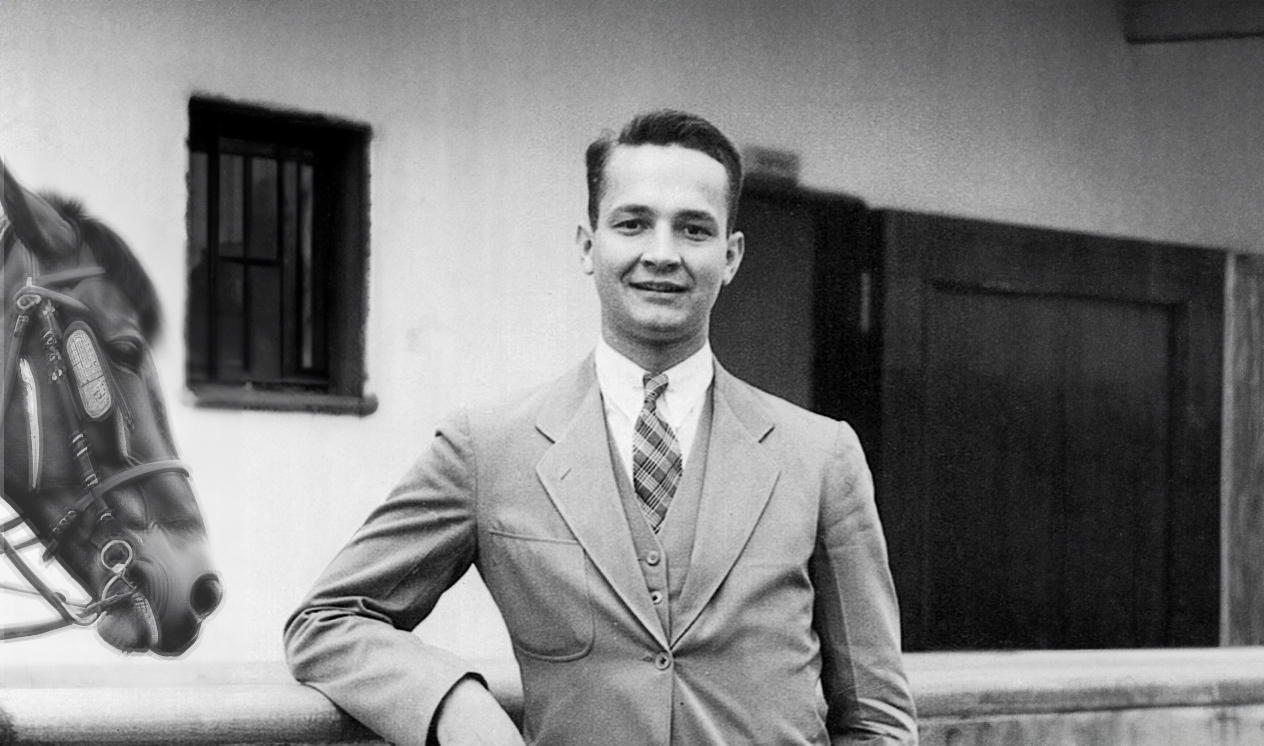

John Marks Templeton was born on November 29, 1912, in the small town of Winchester in the rural state of Tennessee, USA. As a young adult, he broke with the tradition of his hometown and enrolled at the prestigious Yale University, allegedly becoming the first Winchester resident to do so. There, he gained membership in the exclusive secret society “Elihu,” named after the generous benefactor Elihu Yale, and financed part of his economics studies through passionate and successful poker games. In 1934, the future stock market guru graduated with honors as one of the top students in his class.

John Marks Templeton was born on November 29, 1912, in the small town of Winchester in the rural state of Tennessee, USA. As a young adult, he broke with the tradition of his hometown and enrolled at the prestigious Yale University, allegedly becoming the first Winchester resident to do so. There, he gained membership in the exclusive secret society “Elihu,” named after the generous benefactor Elihu Yale, and financed part of his economics studies through passionate and successful poker games. In 1934, the future stock market guru graduated with honors as one of the top students in his class.

Thanks to the coveted “Rhodes Scholarship,” Templeton then enrolled at the elite Oxford University. Although his original desire was to study business, which was not offered at Oxford at that time, he completed a Master’s in Law in 1936. It was only in 1965 that the English established their own management training ground, the “Oxford Centre for Management Studies,” renamed “Templeton College” in 1983 after a generous donation from Templeton.

In his youth, Templeton initially aspired to become a missionary. However, he left the United Kingdom almost two years after completing his studies to work on Wall Street. A nearly legendary episode from Templeton’s career is his first major stock market success. Shortly after the start of World War II in 1939, the future stock market guru bought one hundred shares each of 104 selected companies. These companies supposedly had unfairly devalued stocks, costing less than a dollar and promising a promising turnaround. The result is impressive:

Templeton, who had specifically borrowed for this risky venture, recorded only four total losses. He held onto the remaining one hundred shares for an average of four years, eventually selling them, some at well above the purchase price. The initial $10,000 capital turned into more than $40,000, representing a total performance of over 300 percent. The strategy behind it was surprisingly simple: Templeton bought at the point of maximum pessimism.

This approach later became one of the fundamental pillars of the value strategy. According to this theory, stocks are particularly cheap to acquire when widespread fears prevail, and securities are therefore undervalued. With this approach, Templeton would later become a pioneer of the classic investment fund, bundling various stocks into a single tradable security.