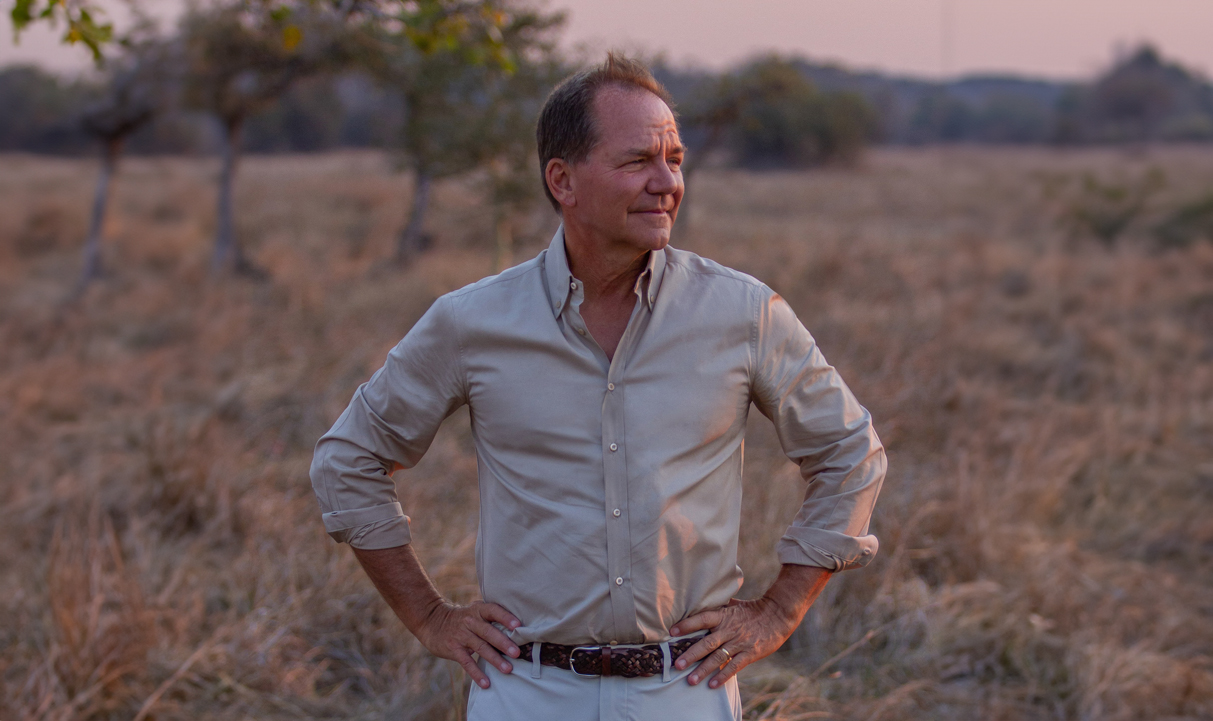

Paul Tudor Jones: At the Top

After his successful prediction of the 1987 stock market crash, Jones was celebrated as a guru in the stock and trading business. This significantly facilitated the attraction of new investors for Tudor Investment Company, leading to a continuous growth of assets under management. Alongside his own trading career, Jones remained active in the industry. For example, he and Hunt Taylor played a significant role in the founding of FINEX, a futures segment at the New York Cotton Exchange. From August 1992 to June 1995, Jones even served as the Chairman of this project.

Paul Tudor Jones Today

Jones continues to be active as a (hedge) fund manager. The Tudor BVI Global, with assets of nearly four billion dollars, has averaged a return of 26% per year since its inception. Jones’ personal wealth is estimated to be around 4 billion US dollars, making him one of the 400 richest people in the world. In 2010, his estimated annual income reached an impressive 440 million dollars. His compensation as an asset manager is 4% of the assets under management per year, plus a 23% performance fee, which is significantly above the market average of 2% and 20%, respectively. At the same time, Jones, as the founder of the non-profit Robin Hood Foundation, advocates for those in need in New York. Politically, he is known as a staunch Republican and has donated substantial sums to politicians such as Rudolph Giuliani and Mitt Romney. Jones is married and has four children.