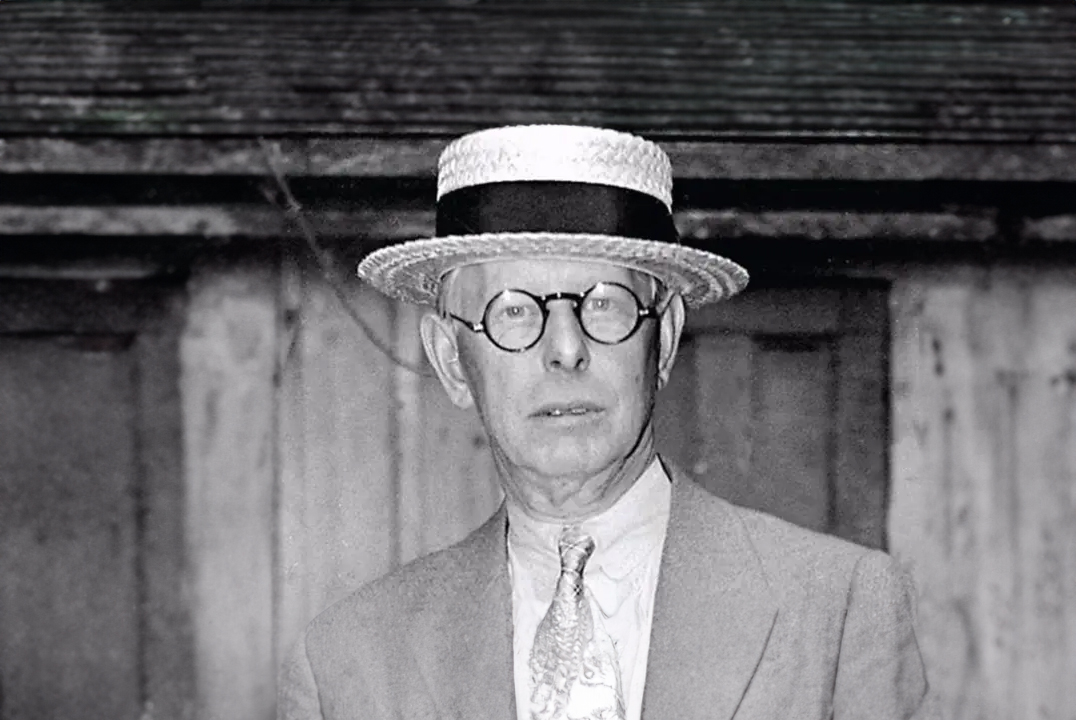

From Field Worker to Stock Trader: The Life Journey of Jesse Livermore

From Field Worker to Stock Trader: The Life Journey of Jesse Livermore

In 1877, Jesse Livermore was born in the state of Massachusetts, USA. Even in his childhood, he experienced the hard work in the fields. He excelled in school, particularly in mathematics. At the age of 14, Livermore left home with only five dollars in his pocket. His path led him to Boston, where he joined a brokerage firm. Later, he referred to this time as “the high school of speculators.” Through sustained success in the so-called “Bucket Shops,” a type of stock betting office, he soon amassed an impressive sum of over $10,000 – a seemingly incredible amount at that time. Jesse Livermore was now ready for the next step: New York, Wall Street, and the pursuit of great wealth.

At the beginning of the 20th century, the major “Money Trusts” like J.P. Morgan or the Rockefeller family dominated the stock exchanges in the USA. In this era, Charles Dow developed his trend theory, and the Dow Jones was published as the leading index of the New York Stock Exchange in the Wall Street Journal. Stock prices were exchanged via telegraph between trading centers worldwide.

Jesse Livermore: From Initial Setbacks to Million-Dollar Losses and Gains

After initial financial challenges in New York and a phase of total bankruptcy, Jesse Livermore perfected his trading strategy, leading to an impressive increase in his account to a six-figure sum. Towards the end of 1906, Livermore sensed a strong overheating of the market and decided to build up significant short positions. At the beginning of the next year, the Dow Jones experienced a sudden crash, and panic spread. Banks were no longer able to provide loans, and trading on Wall Street came to a standstill. In this critical situation, even the most powerful banker in the world, J.P. Morgan, sought Jesse Livermore’s expertise.

Livermore bought back the stocks he had previously sold, the market recovered, and Livermore earned over a million dollars for the first time. However, J.L., as friends called him, did not always strictly adhere to his own trading rules. Acting on the advice of an acquaintance, he converted a short position in cotton into a long position. These and other risky decisions led to Livermore declaring financial bankruptcy once again.